Table of Contents

- Introduction: Why Balance Matters in 2025

- What Is a Balanced Investment Portfolio?

- Step 1: Define Your Financial Goals

- Step 2: Understand Risk Tolerance

- Step 3: Asset Allocation Explained

- Step 4: Diversify Across Asset Classes

- Step 5: Review and Rebalance Regularly

- Step 6: Leverage Free Tools for Smarter Investing

- Case Study: How a 2020s Investor Built a Balanced Portfolio

- Common Mistakes to Avoid in 2025

- Future Trends: The Next Generation of Portfolio Management

- Off-Page & Growth Strategy Tips

- Conclusion: Your Roadmap to Financial Stability

- FAQs

🌍 Introduction: Why Balance Matters in 2025

The year 2025 is redefining what “safe investing” means. Between rising inflation, volatile markets, and AI-driven finance tools, investors can no longer rely on a single strategy.

That’s why building a balanced investment portfolio — one that spreads risk and maximizes long-term growth — is essential.

In this guide, you’ll learn how to create a portfolio that adapts to 2025’s economy, balances stability with opportunity, and helps you sleep well at night — no matter what the markets do.

💡 What Is a Balanced Investment Portfolio?

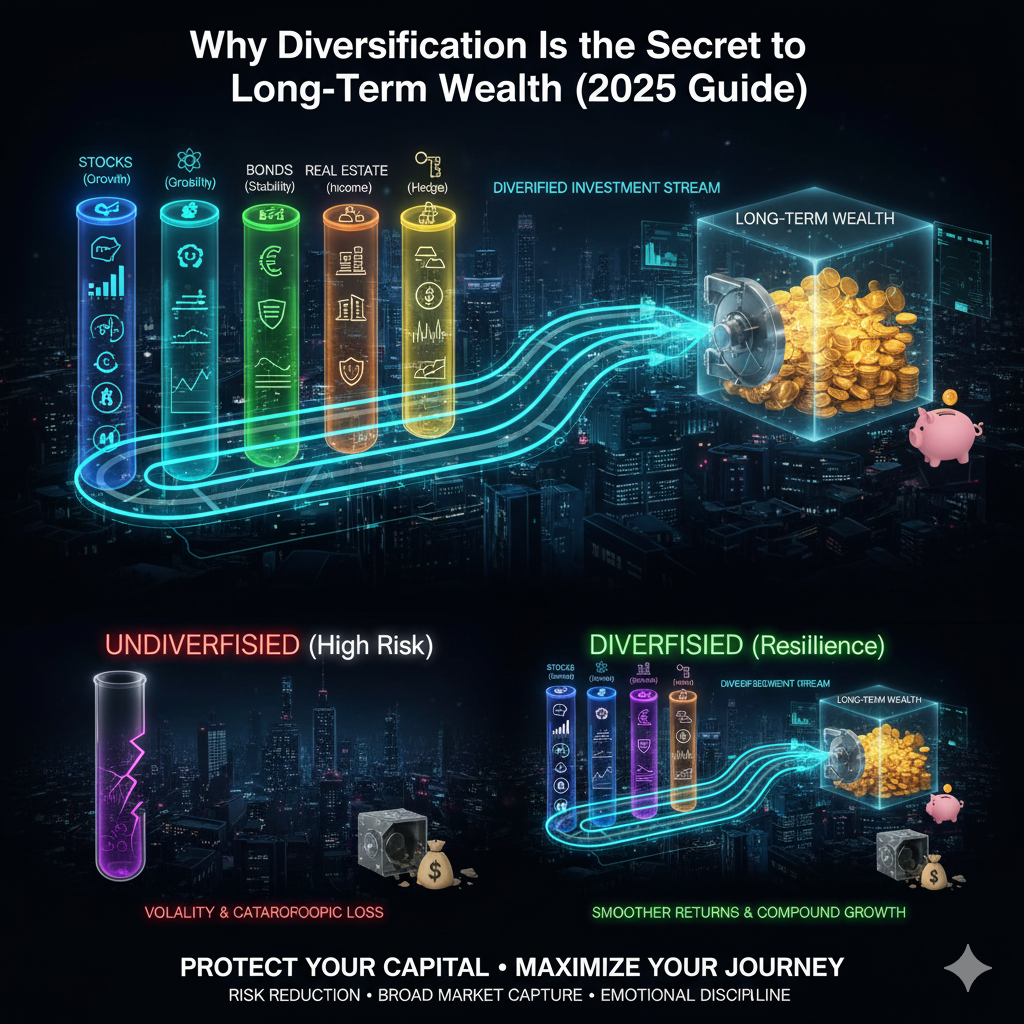

A balanced investment portfolio combines different types of assets — like stocks, bonds, real estate, and cash equivalents — to reduce risk while aiming for consistent returns.

Think of it as a financial safety net: when one asset underperforms, another can help cushion the impact.

🧠 In simple terms: A balanced portfolio = not putting all your eggs in one basket.

Example:

- 60% stocks (growth potential)

- 30% bonds (income + stability)

- 10% cash or alternatives (liquidity)

This mix changes over time based on your age, goals, and market conditions.

🎯 Step 1: Define Your Financial Goals

Before you invest a single dollar, ask:

“What am I investing for — and when will I need the money?”

Common Goals:

- Short-term (1–3 years): Emergency fund, travel, small purchases

- Medium-term (3–10 years): Buying a home, starting a business

- Long-term (10+ years): Retirement, generational wealth

Each goal demands a different level of risk and liquidity.

Example Allocation by Goal:

| Goal | Stocks | Bonds | Cash | Alternatives |

|---|---|---|---|---|

| Short-term | 20% | 40% | 40% | 0% |

| Medium-term | 50% | 40% | 10% | 0% |

| Long-term | 70% | 20% | 5% | 5% |

💬 “Your goals shape your portfolio — not the other way around.” — ExposureNinja Finance Insights, 2024

⚖️ Step 2: Understand Risk Tolerance

Every investor has a unique risk appetite — how much loss they can tolerate before panicking.

🔎 Factors That Influence Risk Tolerance:

- Age

- Income stability

- Investment experience

- Financial dependents

- Emotional comfort with volatility

You can test yours using free tools like:

🧩 Pro Tip: Young investors can afford more risk (more stocks), while retirees should focus on stability (more bonds or income assets).

📊 Step 3: Asset Allocation Explained

Asset allocation is the foundation of a balanced portfolio — it determines how your money is divided among different investment types.

Core Asset Categories:

- Equities (Stocks): High return potential, higher volatility

- Fixed Income (Bonds): Steady income, lower risk

- Real Assets (Real Estate, Gold): Inflation hedge

- Cash or Cash Equivalents: Stability and quick liquidity

- Alternative Investments: Crypto, commodities, REITs, or hedge funds

Example Allocation by Investor Type:

| Investor Type | Stocks | Bonds | Real Assets | Cash |

|---|---|---|---|---|

| Conservative | 40% | 50% | 5% | 5% |

| Balanced | 60% | 30% | 5% | 5% |

| Aggressive | 80% | 10% | 5% | 5% |

🧠 Expert Tip: Revisit your allocation at least once a year — your goals and risk tolerance evolve.

💰 Step 4: Diversify Across Asset Classes

Diversification means spreading investments across sectors, geographies, and instruments to minimize risk.

How to Diversify:

- By Asset Type: Mix stocks, bonds, crypto, and cash.

- By Sector: Invest across industries (tech, healthcare, energy).

- By Geography: Balance U.S., emerging markets, and global ETFs.

- By Size: Include large-cap, mid-cap, and small-cap companies.

Example Tools:

- ETFs like VTI (U.S. market) and VXUS (international exposure)

- Index funds like S&P 500 for broad diversification

- Real estate crowdfunding via Fundrise or REIT ETFs

🏦 Case Insight: According to Backlinko’s 2024 Portfolio Data Report, diversified portfolios had 20–30% lower volatility during market downturns.

🔁 Step 5: Review and Rebalance Regularly

Your portfolio will drift over time as some assets grow faster than others.

Rebalancing means adjusting your investments back to their target allocation.

Example:

If your 60% stocks / 40% bonds portfolio shifts to 70% stocks due to growth, sell some stocks and buy bonds to restore balance.

When to Rebalance:

- Every 6–12 months, or

- When allocation drifts by more than 5–10%

🧮 Use free tools like Google Sheets Investment Tracker or Morningstar Portfolio Manager to monitor balance easily.

🧰 Step 6: Leverage Free Tools for Smarter Investing

Building a balanced portfolio doesn’t require expensive software.

Here are free tools that empower smarter investing:

| Purpose | Tool | Benefit |

|---|---|---|

| Portfolio Tracking | Google Sheets + API integration | Custom tracking dashboard |

| Market Trends | Google Trends | Spot emerging sectors |

| SEO for Finance Blogs | Ubersuggest | Optimize content visibility |

| Risk Analysis | Portfolio Visualizer | Backtest strategies |

| Market Sentiment | Yahoo Finance | Monitor investor mood |

🧩 Combine these free tools for a “DIY Wealth Dashboard.”

🧠 Case Study: How a 2020s Investor Built a Balanced Portfolio

Investor: Sarah M., 32, software engineer from California

Goal: Retire early by 50

Initial Plan (2020):

- 80% Stocks

- 10% Bonds

- 10% Crypto

Problem:

Market volatility during 2022–2023 caused 25% portfolio drawdown.

2025 Strategy Update:

Sarah rebalanced to:

- 60% Stocks

- 25% Bonds

- 10% Real Estate

- 5% Crypto

Result: Lower volatility, smoother returns, and steady growth — achieving 8.7% annualized return post-2023.

💬 “Diversification saved me from panic selling. The balance gave me confidence to stay invested.” — Sarah M.

🚫 Common Mistakes to Avoid in 2025

- Chasing High Returns:

Avoid emotional investing based on hype (e.g., meme stocks, trending cryptos). - Ignoring Inflation:

Ensure assets like TIPS or real estate hedge against rising prices. - Neglecting Emergency Funds:

Always keep 3–6 months’ expenses in cash before investing. - Overdiversifying:

Too many small investments can dilute returns — focus on quality. - Skipping Regular Reviews:

Markets evolve; your portfolio must too.

🔮 Future Trends: The Next Generation of Portfolio Management

1. AI-Driven Portfolio Optimization

AI tools (like Wealthfront’s Path or Betterment AI) now help investors analyze risk and rebalance automatically.

2. Blockchain Transparency

Tokenized assets make investing more accessible and transparent.

3. Sustainable Investing (ESG)

ESG-focused portfolios are expected to represent over 50% of global assets by 2030.

4. Fractional Ownership

Platforms like Public.com and Robinhood let you own stock fractions — perfect for small investors.

5. Global Diversification

With rising global markets, investors in 2025 are looking beyond borders — into Asia, Africa, and emerging economies.

🌐 Off-Page & Growth Strategy Tips

If you’re a finance content creator, here’s how to promote your balanced portfolio guide for backlinks and authority:

- Post educational threads on LinkedIn and Twitter (X)

- Join finance subreddits like r/investing and r/personalfinance

- Write guest articles for blogs like Hackernoon Finance or Investopedia Community

- Use Google Search Console to track performance and keyword ranking

- Build trust signals — author bio, citations, and transparent data sources

🏁 Conclusion: Your Roadmap to Financial Stability

A balanced investment portfolio is your greatest defense against uncertainty.

It’s not about predicting markets — it’s about preparing for them.

By diversifying assets, rebalancing regularly, and aligning investments with your goals, you create a foundation for long-term wealth and peace of mind.

💬 Start small, stay consistent, and let compound growth do the heavy lifting.

❓ FAQs

1. What’s the best portfolio mix in 2025?

For most investors, a 60/30/10 (stocks/bonds/alternatives) split offers balance between growth and safety.

2. How often should I rebalance my portfolio?

Rebalance every 6–12 months or when allocations drift significantly.

3. Should I include crypto in a balanced portfolio?

Yes, but limit it to 5–10% to control volatility.

4. Are ETFs better than individual stocks for balance?

Yes — ETFs like VTI or VOO give instant diversification.

5. How can I track my portfolio for free?

Use Google Sheets, Morningstar, or Yahoo Finance Portfolio Tracker.