Table of Contents

- Introduction: The Timeless Power of Diversification

- What Is Diversification in Investing?

- Why Diversification Matters for Long-Term Wealth

- Types of Diversification Every Investor Should Know

- How Diversification Protects You During Market Volatility

- Building a Diversified Portfolio in 2025

- Common Mistakes to Avoid in Diversification

- Pro Tips and Free Tools for Smarter Diversification

- Real-World Examples of Diversified Portfolios

- Conclusion: Make Diversification Your Wealth Strategy

- FAQs

Introduction: The Timeless Power of Diversification

If there’s one principle that every seasoned investor swears by, it’s diversification.

In a world of economic uncertainty and market fluctuations, spreading your investments across different assets isn’t just a strategy—it’s a survival skill.

In this guide, you’ll learn why diversification remains the cornerstone of long-term wealth, how to apply it effectively in 2025, and which mistakes to avoid.

Whether you’re a beginner or an experienced investor, mastering diversification will help you sleep better, knowing your financial future is balanced and secure.

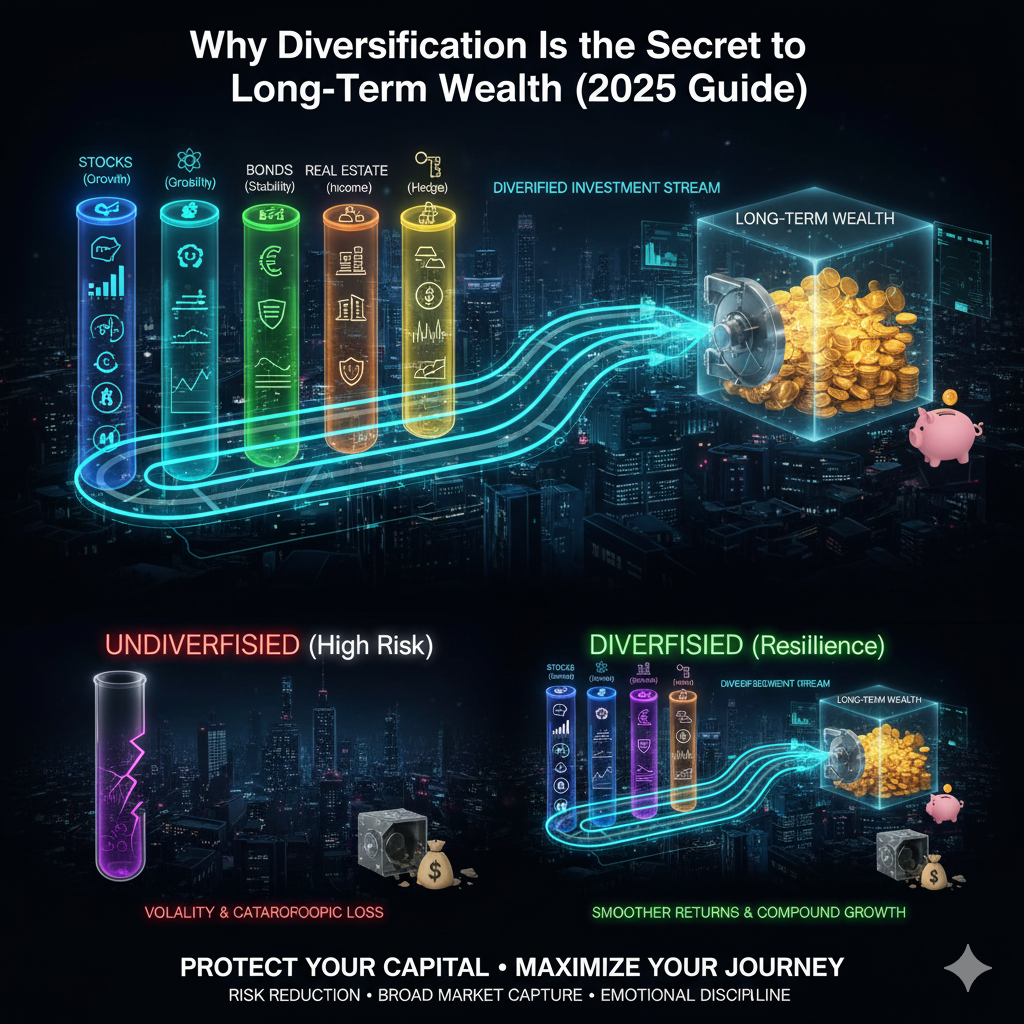

What Is Diversification in Investing?

Diversification means distributing your money across multiple investments so that poor performance in one doesn’t wipe out your entire portfolio.

Think of it like this: if you put all your eggs in one basket and drop it, you lose everything. But if you spread them across several baskets, one fall won’t break them all.

The Goal of Diversification

- Reduce overall portfolio risk.

- Improve the consistency of returns.

- Balance growth potential with capital protection.

Example:

Instead of investing 100% in tech stocks, a diversified investor might allocate:

- 40% in stocks (across sectors)

- 30% in bonds

- 20% in real estate or REITs

- 10% in cash or commodities

Why Diversification Matters for Long-Term Wealth

Diversification isn’t about avoiding risk—it’s about managing it.

According to Nobel laureate Harry Markowitz, diversification forms the foundation of the Modern Portfolio Theory (MPT), which shows that spreading investments can maximize returns for a given level of risk.

Benefits of Diversification

- Reduces Volatility — When one asset class dips, others may rise, stabilizing your returns.

- Protects Against Uncertainty — No one can predict market crashes or recessions.

- Encourages Consistent Growth — Long-term portfolios thrive on steady, compounding returns.

- Minimizes Emotional Decisions — A balanced mix keeps investors from panic-selling during downturns.

💡 Expert Insight: Exposure Ninja suggests that well-diversified portfolios outperform concentrated ones in most 10-year periods.

Types of Diversification Every Investor Should Know

1. Asset Class Diversification

Spread investments among stocks, bonds, commodities, and real estate to balance risk and reward.

2. Industry Diversification

Avoid concentrating all investments in one sector. For instance, mix technology, healthcare, finance, and consumer goods.

3. Geographic Diversification

Include both domestic and international assets to protect against country-specific risks.

4. Time Diversification

Invest consistently over time (via dollar-cost averaging) instead of lump-sum investing.

5. Risk Level Diversification

Combine high-risk, high-return assets with safer investments for a balanced portfolio.

How Diversification Protects You During Market Volatility

Imagine this scenario:

- The stock market crashes.

- Real estate values dip slightly.

- Bond yields rise.

If you’ve diversified across all three, the bond gains and smaller losses in real estate can offset the stock market drop.

Historical Example:

During the 2008 financial crisis, diversified portfolios recovered nearly two years earlier than stock-only portfolios (Morningstar data).

Pro Tip: Rebalancing your portfolio yearly ensures your asset mix stays aligned with your goals.

Building a Diversified Portfolio in 2025

With global markets evolving and new asset classes emerging, diversification strategies are broader than ever.

Step 1: Assess Your Risk Tolerance

Determine how much volatility you can handle.

Use free tools like Vanguard’s Risk Tolerance Questionnaire or SmartAsset’s Portfolio Analyzer.

Step 2: Choose Core Asset Classes

A solid 2025 portfolio might include:

- Stocks (domestic + global)

- Bonds (government + corporate)

- Real Estate (REITs)

- Commodities or Gold ETFs

- Cash equivalents

Step 3: Add Alternative Investments

Consider exposure to emerging areas like:

- AI-driven ETFs

- Crypto index funds

- Peer-to-peer lending

Step 4: Rebalance Regularly

Markets shift over time. Rebalancing ensures you stay on track with your target allocation.

🧭 Example: If stocks rise faster than bonds, your portfolio may become riskier. Rebalancing sells a portion of stocks and reallocates to bonds.

Common Mistakes to Avoid in Diversification

Even good intentions can go wrong. Watch out for these pitfalls:

- Over-Diversification: Too many holdings can dilute returns.

- Ignoring Correlation: Diversify across assets that don’t move in sync.

- Set-and-Forget Mindset: Regular reviews are essential.

- Neglecting Costs: High management fees can eat into profits.

- Emotional Reactions: Fear-based selling breaks diversification discipline.

⚠️ According to Morningstar, portfolios with 20–30 well-chosen assets achieve 90% of diversification benefits — beyond that, gains are marginal.

Pro Tips and Free Tools for Smarter Diversification

| Tool | Purpose | Website |

|---|---|---|

| Google Finance | Track multi-asset portfolios | finance.google.com |

| Morningstar Portfolio Manager | Analyze risk and diversification levels | morningstar.com |

| Ubersuggest | Keyword & trend insights for market analysis | neilpatel.com/ubersuggest |

| Personal Capital | Free financial tracking and allocation insights | personalcapital.com |

🔍 Use Google Trends to explore rising investment sectors for new diversification opportunities.

Real-World Examples of Diversified Portfolios

Example 1: Conservative Investor (Low Risk)

- 40% Bonds

- 30% Dividend Stocks

- 20% Real Estate

- 10% Cash

Example 2: Balanced Investor (Moderate Risk)

- 50% Stocks

- 25% Bonds

- 15% Real Estate

- 10% Alternatives

Example 3: Aggressive Investor (High Risk)

- 70% Stocks

- 15% Crypto/Tech ETFs

- 10% Bonds

- 5% Commodities

Each reflects a unique blend based on risk appetite and investment goals.

Conclusion: Make Diversification Your Wealth Strategy

Diversification isn’t just an investment tactic—it’s a wealth philosophy.

By spreading risk across various assets, sectors, and geographies, you create a safety net that cushions against downturns while fueling long-term growth.

In 2025, the smartest investors aren’t those chasing the next big thing—they’re the ones balancing growth and stability through disciplined diversification.

💬 Action Step: Review your portfolio this week and rebalance using free tools like Morningstar or Personal Capital to ensure you’re truly diversified.

FAQs

1. How many investments should I hold for good diversification?

Generally, 20–30 assets across various sectors and asset classes provide strong diversification without overcomplication.

2. Can ETFs help with diversification?

Absolutely. Exchange-Traded Funds (ETFs) provide instant diversification by holding multiple stocks or bonds within one fund.

3. Should I include crypto in a diversified portfolio?

Yes, but keep it small (typically under 5–10%) due to its volatility.

4. How often should I rebalance my portfolio?

Once or twice a year, or when your asset mix deviates by 5% or more from your target allocation.

5. Is diversification a guarantee against losses?

No strategy can eliminate risk, but diversification significantly reduces the impact of poor-performing assets.