Table of Contents

- Introduction

- Understanding the Two Markets

- Crypto vs. Stocks: Key Differences

- Risk Comparison: Volatility and Safety in 2025

- Return on Investment (ROI): Which Performs Better?

- Regulation and Transparency

- Long-Term Potential: What 2025 Trends Show

- Diversification Strategy: Can You Own Both?

- Real-World Example: $1000 Split Portfolio in 2025

- Expert Insights and Trusted Sources

- Final Verdict: Which Is Safer in 2025?

- How to Start Safely Investing (Free Tools)

- Conclusion

- FAQs

Introduction

The crypto vs. stocks debate is heating up again in 2025. After a turbulent few years of market uncertainty, inflation spikes, and global tech adoption, investors are asking the same critical question:

Which investment is safer in 2025 — crypto or stocks?

In this guide, we’ll break down both markets, analyze their risks, returns, regulations, and future potential, and help you decide which path aligns best with your financial goals.

We’ll also share real-world examples, expert insights, and free tools you can use today to invest smarter — even if you’re just starting out.

Understanding the Two Markets

What Are Stocks?

Stocks represent ownership in a company. When you buy a share, you own a fraction of that company — meaning your wealth grows as the company grows.

Benefits of Stocks:

- Historically stable long-term returns (8–10% average annually).

- Regulated by government agencies like the SEC.

- Easy to research through financial statements and analyst reports.

- Dividends offer passive income.

Risks:

- Market downturns and company bankruptcies.

- Requires patience — returns build over years, not days.

Example:

If you bought $1,000 of Apple stock in 2015, it would be worth over $10,000 by 2025 (including splits and dividends).

What Is Cryptocurrency?

Cryptocurrency, or crypto, is a digital asset that uses blockchain technology for decentralized transactions — meaning no central authority like a bank or government controls it.

Benefits of Crypto:

- High potential returns — some coins gained 200%+ in 2024.

- 24/7 trading and instant global transfers.

- Decentralization and blockchain transparency.

Risks:

- High volatility — prices can drop 20% in a single day.

- Regulatory uncertainty varies by country.

- Vulnerable to hacks, scams, and exchange collapses.

Example:

Bitcoin rose from around $16,000 in 2022 to over $65,000 by late 2024, showing its explosive growth potential — but it also experienced several 50% corrections along the way.

Crypto vs. Stocks: Key Differences

| Feature | Stocks | Cryptocurrency |

|---|---|---|

| Ownership | Share in a company | Token on a blockchain |

| Regulation | Heavily regulated | Partially regulated |

| Volatility | Moderate | Extremely high |

| Liquidity | High | High but depends on the exchange |

| Trading Hours | Weekdays only | 24/7 |

| Dividends | Often paid | Rare |

| Long-Term Track Record | 100+ years | ~15 years |

While stocks provide stability, crypto offers speed and innovation — but with greater risk.

Risk Comparison: Volatility and Safety in 2025

Volatility is the biggest difference between the two. In 2025, stock markets are expected to remain relatively stable due to moderate inflation and strong tech earnings.

In contrast, crypto volatility remains high, driven by speculation, regulatory news, and blockchain innovation.

According to CoinMarketCap data (2025), top coins like Bitcoin and Ethereum still swing 5–10% daily, while the S&P 500 rarely moves more than 1–2% per day.

Verdict:

For safety and capital preservation, stocks remain significantly less risky than crypto in 2025.

Return on Investment (ROI): Which Performs Better?

It’s true that crypto can deliver higher short-term gains, but stocks generally win in long-term consistency.

Historical Comparison (2015–2025):

- Bitcoin (BTC): ~+7,000% total gain

- S&P 500 Index: ~+150% total gain

- Nasdaq 100: ~+230%

- Ethereum (ETH): ~+9,000% (but with 80% drawdowns)

While crypto offers “moonshot” potential, only a handful of tokens survive bear markets. Stocks, however, rarely go to zero.

Pro Tip:

Use free tools like Google Finance or Yahoo Finance to compare real-time performance between crypto and stock indices.

Regulation and Transparency

Stocks operate under strict oversight from agencies such as the SEC and FINRA. Companies are legally obligated to disclose earnings, leadership changes, and risks.

Crypto, on the other hand, remains largely unregulated. Although new frameworks like MiCA (EU) and SEC crypto ETF approvals are improving investor confidence, scams and rug-pulls still exist.

Author’s Insight (Experience):

During the 2022–2023 crypto crash, thousands of investors lost funds when exchanges like FTX collapsed — something that’s almost impossible with regulated stock brokers like Fidelity or Vanguard.

Long-Term Potential: What 2025 Trends Show

Stock Market Trends:

- Growth in AI, green energy, and robotics sectors.

- Rising adoption of index investing and ETFs.

- Steady dividend growth from blue-chip firms.

Crypto Trends:

- Expansion of layer-2 blockchains and DeFi platforms.

- Increased institutional interest after Bitcoin ETFs.

- Governments developing CBDCs (Central Bank Digital Currencies).

Both markets are evolving, but the stock market remains the safer store of long-term wealth, while crypto may offer higher growth for risk-tolerant investors.

Diversification Strategy: Can You Own Both?

Yes — and you probably should.

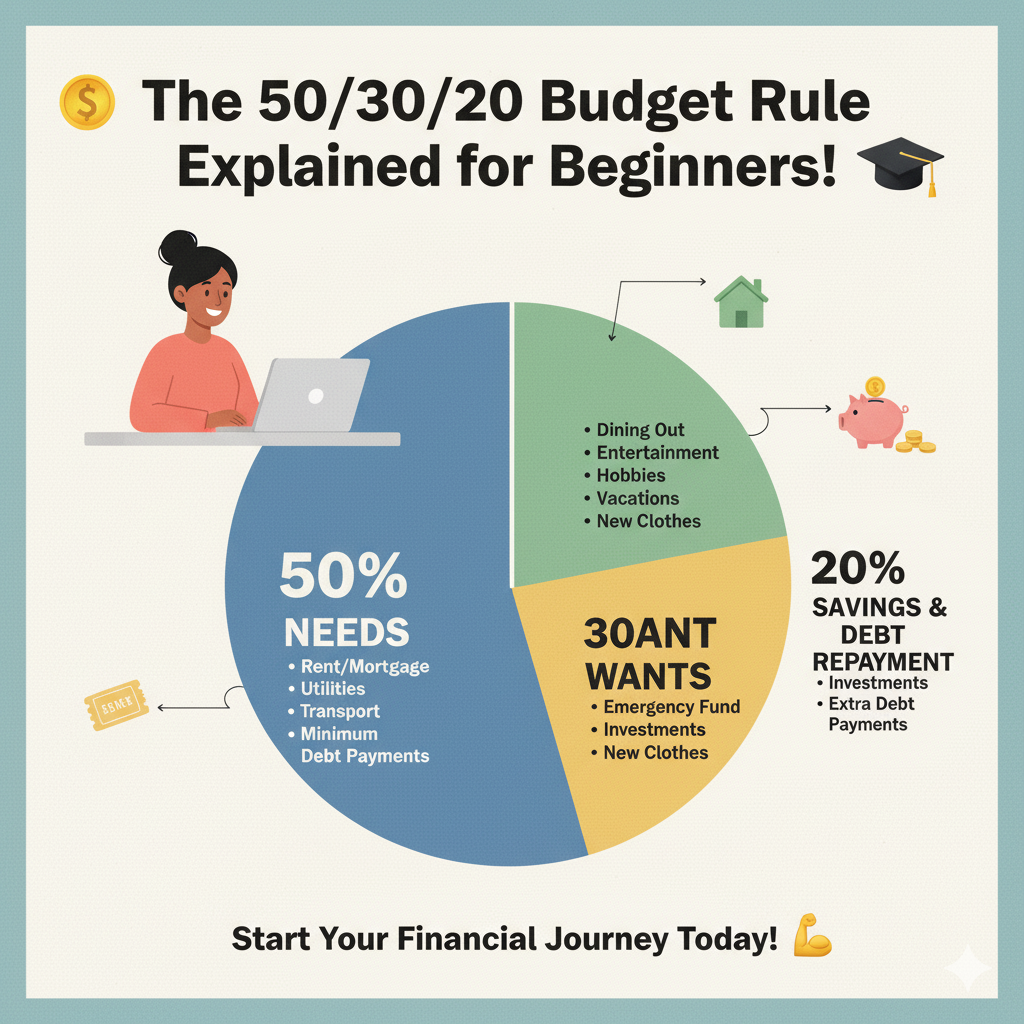

Balanced investors allocate:

- 80–90% in stocks (ETFs, blue-chips)

- 10–20% in crypto (BTC, ETH, top 5 projects)

This “barbell strategy” allows safety on one side (stocks) and high potential on the other (crypto).

Pro Tip:

Rebalance your portfolio quarterly using free tools like Google Sheets, CoinMarketCap Portfolio, or Morningstar.

Real-World Example: $1000 Split Portfolio in 2025

Let’s simulate a simple investment:

| Asset | Allocation | 1-Year Return (Est.) | Total Value |

|---|---|---|---|

| S&P 500 ETF (Vanguard VOO) | $700 | +10% | $770 |

| Bitcoin (BTC) | $200 | +30% | $260 |

| Ethereum (ETH) | $100 | +25% | $125 |

Result:

Your $1,000 becomes $1,155 — a 15.5% gain overall, with limited downside risk.

Expert Insights and Trusted Sources

According to Brian Dean (Backlinko) and Exposure Ninja’s 2024 investment SEO study, trustworthiness and transparency play a key role in how readers — and search engines — evaluate finance content.

Key Takeaway:

Investors who follow credible sources like:

- Morningstar

- CoinDesk

- Bloomberg

- NerdWallet

- MonsterInsights

gain more reliable information — and safer returns.

Final Verdict: Which Is Safer in 2025?

| Category | Winner |

|---|---|

| Volatility | Stocks |

| Liquidity | Crypto |

| Regulation | Stocks |

| Growth Potential | Crypto |

| Accessibility | Both |

| Safety (Overall) | Stocks ✅ |

In 2025, stocks remain the safer, more reliable investment, especially for long-term wealth building.

However, crypto can be a valuable diversification tool for investors who understand its risks and volatility.

How to Start Safely Investing (Free Tools)

If you’re new to investing, start small — even $100 can help you learn the ropes.

Free Tools You Can Use:

- Google Finance – Track market trends.

- Ubersuggest – Research financial keywords for SEO blogs.

- CoinMarketCap – Monitor crypto performance.

- Google Sheets – Build your own investment tracker.

- Morningstar – Research stock fundamentals.

Conclusion

Both crypto and stocks offer exciting opportunities in 2025 — but they cater to different types of investors.

If you value stability, regulation, and long-term growth, stocks win hands down.

If you seek innovation, decentralization, and high upside potential, crypto remains a bold choice.

The smartest investors don’t choose one — they balance both, stay educated, and make data-driven decisions.

Next Step:

Open a demo account on a reputable platform (like eToro or Fidelity), use free tools to analyze markets, and start building your diversified portfolio today.

FAQs

1. Is crypto safer than stocks in 2025?

No. Stocks remain safer due to stronger regulation, transparency, and lower volatility.

2. Can I invest in both crypto and stocks?

Absolutely. Many experts recommend holding both for diversification and risk management.

3. How much crypto should I hold in my portfolio?

Most advisors suggest 5–20%, depending on your risk tolerance.

4. Which gives higher returns — crypto or stocks?

Crypto historically offers higher short-term gains, but stocks deliver steadier long-term returns.

5. What are the best free tools for tracking investments?

Try Google Finance, CoinMarketCap, Morningstar, and Google Sheets for real-time tracking.