Table of Contents

- Introduction: The Secret Behind Undervalued Stocks

- What Does “Undervalued Stock” Really Mean?

- Why Investors Love Undervalued Stocks

- Key Financial Ratios to Spot Undervalued Stocks

- Free Tools to Help You Find Undervalued Stocks

- Qualitative Analysis: Beyond the Numbers

- Case Study: How Warren Buffett Identifies Value

- Common Mistakes to Avoid When Picking Value Stocks

- Pro Tips: Building a Long-Term Value Investing Strategy

- Conclusion: Turning Knowledge into Profit

- FAQs

🪙 Introduction: The Secret Behind Undervalued Stocks

Have you ever wondered how seasoned investors like Warren Buffett or Benjamin Graham consistently find winning stocks? The secret isn’t luck — it’s the ability to identify undervalued stocks before the market catches on.

In this guide, you’ll learn how to evaluate companies, use valuation ratios, apply free tools, and think like a professional investor. By the end, you’ll know exactly how to spot value opportunities hiding in plain sight — even if you’re a beginner.

💡 What Does “Undervalued Stock” Really Mean?

An undervalued stock is one that trades below its intrinsic value — the true worth of the company based on its fundamentals, assets, and growth potential.

Think of it this way:

If a company’s shares are selling for $50, but analysis shows its fair value is $80, that’s a potential opportunity — the market hasn’t fully recognized its worth yet.

This mismatch between price and value is what value investors hunt for.

💰 Why Investors Love Undervalued Stocks

Investing in undervalued stocks can lead to:

- Higher returns: Buy low, sell high when the market corrects itself.

- Lower risk: Companies with solid fundamentals are less likely to fail.

- Steady growth: You gain from both price appreciation and dividends.

- Compounding potential: Reinvesting returns accelerates long-term wealth.

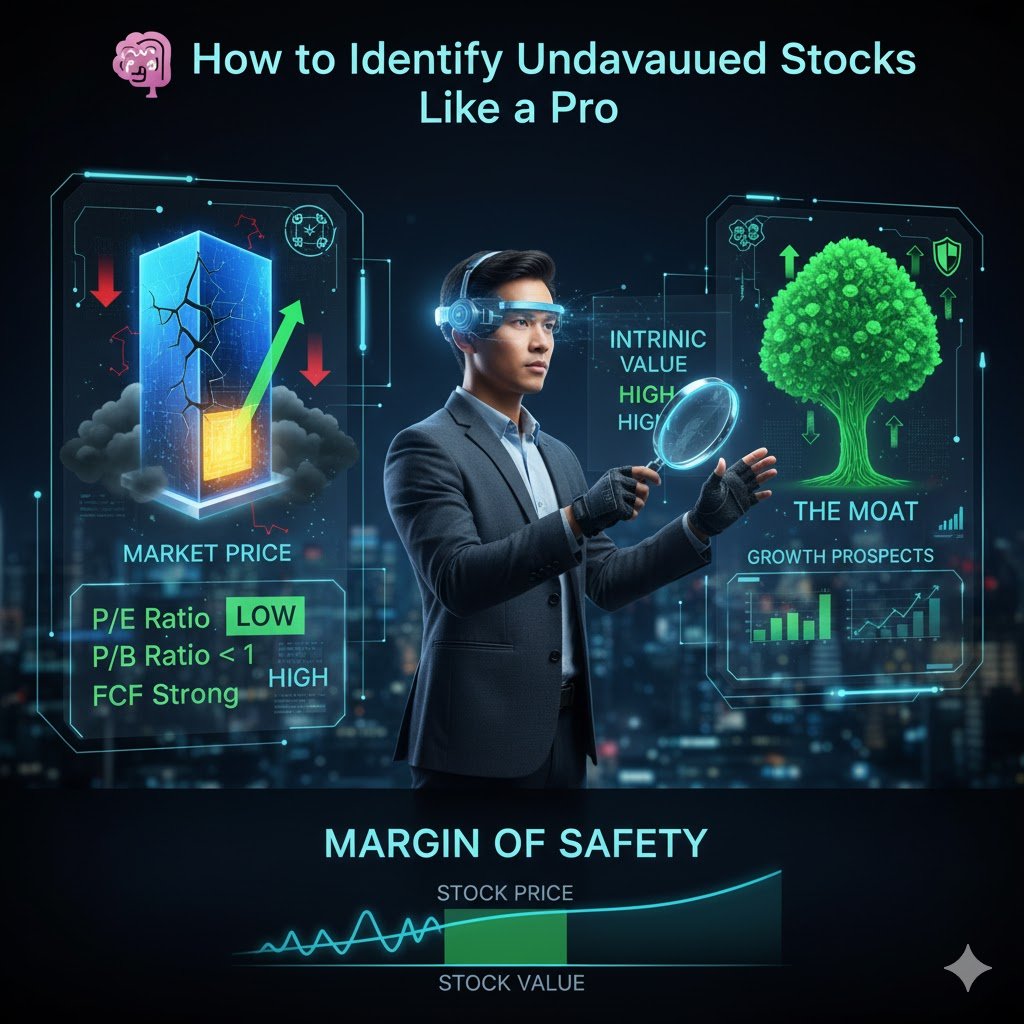

📊 Key Financial Ratios to Spot Undervalued Stocks

The foundation of identifying undervalued stocks lies in mastering valuation ratios. These metrics reveal whether a stock is cheap or overpriced relative to its earnings, assets, and growth.

1. Price-to-Earnings (P/E) Ratio

Formula:

P/E = Stock Price ÷ Earnings Per Share (EPS)

A low P/E ratio compared to industry peers may signal undervaluation — but it’s not a guarantee. For example, tech companies usually have higher P/Es due to growth expectations, while industrials may have lower ones.

Pro Tip: Use forward P/E (based on projected earnings) for a better growth outlook.

2. Price-to-Book (P/B) Ratio

Formula:

P/B = Market Price per Share ÷ Book Value per Share

A P/B ratio below 1.0 can indicate the market values a company below its net assets — a potential undervaluation. However, be cautious with industries that rely heavily on intangible assets (like software).

3. Dividend Yield

Dividend-paying undervalued stocks are gold for long-term investors.

Formula:

Dividend Yield = Annual Dividend ÷ Current Share Price

A high, sustainable dividend yield can suggest that the stock offers both income and value — as long as the payout ratio is reasonable (below 60%).

4. Debt-to-Equity Ratio

Formula:

D/E = Total Debt ÷ Total Shareholders’ Equity

Too much debt can sink even the most promising stock. Look for D/E ratios below 1.0 for a healthy balance sheet and lower financial risk.

🧰 Free Tools to Help You Find Undervalued Stocks

You don’t need paid platforms to analyze stocks like a pro. Here are free tools that help you uncover value opportunities:

- Yahoo Finance: For stock screeners, key ratios, and historical charts.

- Finviz: Free filters to screen by P/E, P/B, market cap, and dividend yield.

- Google Finance: Great for quick comparisons and tracking portfolios.

- Morningstar (Free Tier): Offers analyst insights and fair value estimates.

- Seeking Alpha (Free Access): Useful for reading bullish/bearish opinions.

💡 Use these tools to create watchlists, set alerts, and compare metrics side by side.

🧩 Qualitative Analysis: Beyond the Numbers

Numbers tell one side of the story. The qualitative side — company leadership, brand power, and competitive advantage — often determines whether a stock will outperform.

Here’s what to evaluate:

- Management quality: Look for experienced, transparent leadership.

- Moat: Does the company have a unique advantage (brand, tech, patents)?

- Industry position: Is it leading or lagging its competitors?

- Innovation: Are they adapting to market changes or stuck in the past?

- ESG factors: Investors increasingly reward sustainable, ethical companies.

📚 Case Study: How Warren Buffett Identifies Value

Warren Buffett, CEO of Berkshire Hathaway, follows the principles of value investing laid out by Benjamin Graham.

Here’s how Buffett does it:

- Looks for undervalued quality: Companies with durable advantages.

- Buys with a margin of safety: Only when the market price is below intrinsic value.

- Holds long-term: Letting compounding work over decades.

Example: Buffett bought Coca-Cola shares in 1988 when it was undervalued. Decades later, it remains one of Berkshire’s best-performing holdings — paying billions in dividends.

⚠️ Common Mistakes to Avoid When Picking Value Stocks

Even seasoned investors make errors. Avoid these pitfalls:

- Chasing low prices: Cheap doesn’t always mean undervalued.

- Ignoring industry trends: Some sectors (like coal) may be cheap for a reason.

- Skipping qualitative research: A strong balance sheet can’t fix poor leadership.

- Over-diversifying: Too many positions dilute your best ideas.

- Emotional investing: Stick to data, not hype or fear.

💼 Pro Tips: Building a Long-Term Value Investing Strategy

- Start small, scale smart: Invest gradually using dollar-cost averaging.

- Reinvest dividends: Compound your returns automatically.

- Monitor regularly: Use Google Alerts or portfolio trackers.

- Stay patient: Market corrections can take months or years.

- Learn continuously: Follow credible sources like Morningstar, Motley Fool, and Backlinko Finance for evolving strategies.

🧠 Conclusion: Turning Knowledge into Profit

Identifying undervalued stocks isn’t about chasing hype — it’s about discipline, patience, and understanding value.

By combining financial ratios, qualitative analysis, and free research tools, you can build a portfolio that grows steadily — regardless of market noise.

Whether you’re a beginner or an experienced investor, mastering the art of spotting undervalued stocks will give you the edge you need to invest smarter and build lasting wealth.

❓ FAQs

1. What’s the easiest way to find undervalued stocks?

Use free screeners like Finviz or Yahoo Finance to filter stocks by low P/E, P/B below 1, and stable earnings growth.

2. Are undervalued stocks always profitable?

Not always. Some are value traps — they look cheap but have weak fundamentals or poor growth prospects.

3. How long should I hold undervalued stocks?

Typically 3–5 years or more. Value realization takes time as markets adjust.

4. Should beginners invest in undervalued stocks?

Yes, but start small and focus on well-known, financially stable companies.

5. What’s the best sector for undervalued opportunities?

Historically, financials, industrials, and energy sectors often harbor undervalued gems after market downturns.