🧭 Table of Contents

- Introduction

- Step 1 – Assess Your Current Debt

- Step 2 – Create a Realistic Budget

- Step 3 – Choose the Right Debt Repayment Strategy

- Step 4 – Negotiate Lower Interest Rates

- Step 5 – Increase Your Income

- Step 6 – Automate & Track Your Progress

- Step 7 – Stay Debt-Free for Life

- Free Tools for Debt-Free Living in 2025

- Conclusion

- FAQ

Introduction

If you’re reading this, chances are you’re tired of watching your paycheck disappear into loan payments and credit-card bills.

You’re not alone — according to CNBC (2025), the average American household carries over $101,000 in debt, from mortgages to student loans and credit cards.

But here’s the good news: you can be completely debt-free in 2025 with the right strategy, mindset, and systems in place.

This guide will walk you step-by-step through the exact process financial coaches and real people use to erase debt — without stress or complicated math.

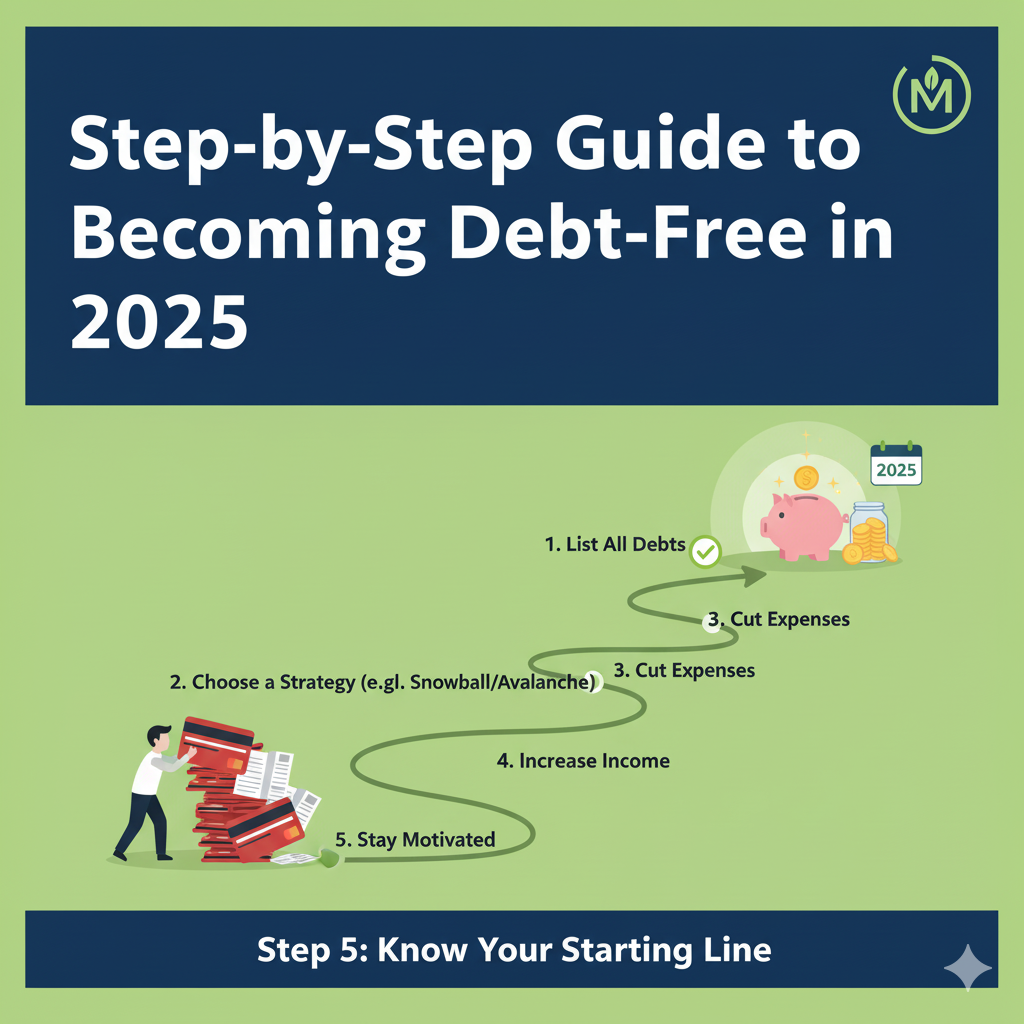

Step 1 – Assess Your Current Debt

Before you can fix your finances, you need to face them head-on. List every debt you owe, including:

- Credit cards

- Personal loans

- Auto loans

- Student loans

- Medical bills

- Mortgage (optional if long-term)

Action Plan:

- Gather your most recent statements.

- Note down total balance, interest rate, and minimum payment for each.

- Use a free tool like Mint or Credit Karma to automatically track your accounts.

Pro Tip:

Focus on your interest rates — that number determines which debts cost you the most each month.

Step 2 – Create a Realistic Budget

A working budget is your roadmap to freedom. The goal isn’t perfection — it’s awareness.

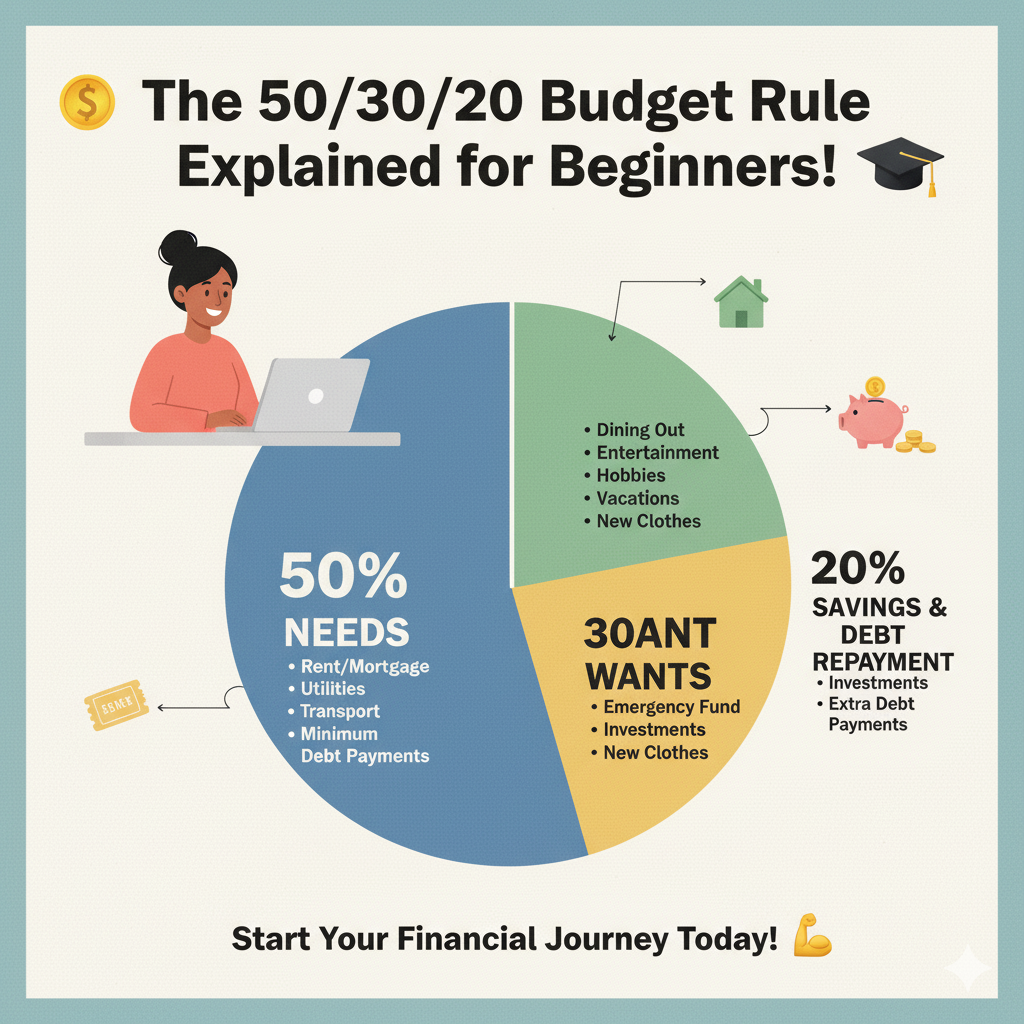

Use the 50/30/20 Budget Rule:

- 50% Needs: Rent, food, insurance, utilities

- 30% Wants: Dining, entertainment, shopping

- 20% Savings/Debt: Pay down high-interest debt first

Example:

If you earn $4,000/month:

- $2,000 → Needs

- $1,200 → Wants

- $800 → Debt payments or savings

You can create your budget using:

- EveryDollar for zero-based budgeting

- YNAB (You Need A Budget) for goal-based budgeting

- Google Sheets templates for a free DIY approach

Step 3 – Choose the Right Debt Repayment Strategy

Once you know what you owe, it’s time to choose your game plan. Two proven methods dominate personal finance:

🧊 The Avalanche Method

- Focus on the highest-interest debt first

- Mathematically saves more money over time

- Ideal for analytical or disciplined personalities

❄️ The Snowball Method

- Focus on the smallest debt first

- Builds quick motivation as you see wins

- Perfect for beginners or emotional motivators

Hybrid Strategy:

Start with the Snowball for 3–6 months to gain momentum, then switch to Avalanche to minimize interest.

Step 4 – Negotiate Lower Interest Rates

If you’re serious about becoming debt-free, negotiating your rates can save hundreds per year.

How to Negotiate:

- Call your credit-card company and ask for a lower APR.

- Mention your on-time payment history and competitor offers.

- Use a script like: “Hi, I’ve been a loyal customer and always pay on time. Could you review my account and offer a lower rate?”

Alternative Options:

- Apply for a 0% balance-transfer card (check NerdWallet for 2025 offers).

- Consolidate high-interest loans using SoFi or Upstart.

Step 5 – Increase Your Income

Cutting costs only goes so far. To speed up your debt-free journey, focus on boosting income.

Ideas for 2025 Side Hustles:

- Freelance on Upwork, Fiverr, or Toptal

- Rent a spare room on Airbnb

- Deliver groceries with Instacart or DoorDash

- Sell unused items on eBay or Facebook Marketplace

Passive-Income Boosters:

- Use cash-back apps like Rakuten or Ibotta

- Invest spare change via Acorns (after debt payoff)

Pro Tip:

Every extra $100 you earn can erase $1,200+ in annual interest when redirected to debt.

Step 6 – Automate & Track Your Progress

Staying consistent is easier when automation does the heavy lifting.

Automate These 3 Things:

- Minimum payments for every debt (avoid late fees)

- Extra payment on your current target debt

- Monthly budget updates with tools like Mint or YNAB

Track your results monthly:

- Use Google Sheets or Notion to visualize your debt decline.

- Celebrate milestones — e.g., “Credit-card #1 paid off!”

Step 7 – Stay Debt-Free for Life

Becoming debt-free is half the battle — staying that way requires habits.

Long-Term Habits to Build:

- Build a 3–6-month emergency fund

- Use credit cards only for rewards you can pay off monthly

- Review your credit score quarterly via AnnualCreditReport.com

- Keep learning — follow financial educators like Dave Ramsey, Clever Girl Finance, and Graham Stephan

Free Tools for Debt-Free Living in 2025

| Category | Free Tool | Purpose |

|---|---|---|

| Budgeting | Mint | Track spending & categorize transactions |

| Debt Tracking | Undebt.it | Create a custom payoff plan |

| Credit Score | Credit Karma | Monitor score & get personalized tips |

| Negotiation | NerdWallet Card Finder | Compare 0% balance-transfer cards |

| Side Income | Fiverr | Freelance marketplace |

| Learning | Investopedia Simulator | Practice investing safely |

Conclusion

Becoming debt-free in 2025 isn’t about luck — it’s about having a clear plan, consistent action, and the right mindset.

By assessing your debt, creating a realistic budget, using smart repayment methods, and boosting income, you can regain control of your finances and your future.

Remember: Debt freedom equals peace of mind.

Start small, stay disciplined, and imagine where you’ll be this time next year — living debt-free and stress-free.

FAQ

1. How long does it take to become debt-free?

Most people can eliminate consumer debt within 12–24 months using the avalanche or snowball method — depending on income and discipline.

2. Should I pay off debt or save first?

Always cover basic emergencies ($1,000–$2,000) before aggressively paying debt. That way, you won’t need to borrow again.

3. Does debt consolidation hurt credit?

It may cause a temporary dip from a hard inquiry but can improve your score long-term by lowering utilization and simplifying payments.

4. What’s the fastest way to raise my credit score after paying debt?

Keep old accounts open, pay on time, and maintain low utilization (<30%).

Tools like Experian Boost can add utility or rent payments to your score.

5. Are debt-relief companies worth it?

Be cautious — many charge high fees. Always check BBB ratings and try non-profit credit counseling first via NFCC.org.