Table of Contents

- Introduction: The Rise of AI in Trading

- What Is AI-Based Trading?

- How AI Is Changing the Trading Landscape

- Types of AI Trading Systems

- Benefits of AI Trading

- Risks and Challenges of AI-Based Trading

- Real-World Examples of AI in Action

- AI vs. Human Traders: Who Performs Better?

- How Beginners Can Safely Use AI Trading Tools

- The Future of AI Trading: Trends to Watch in 2025 and Beyond

- Free Tools for Smarter AI-Assisted Investing

- Conclusion: Is AI Trading Worth the Risk?

- FAQs

🚀 Introduction: The Rise of AI in Trading

Artificial Intelligence (AI) is no longer just powering chatbots or self-driving cars — it’s revolutionizing financial markets. In 2025, AI-based trading platforms are handling over 70% of U.S. stock trades, according to MarketsandMarkets.

For traders, this sounds like a dream: faster decisions, no emotions, 24/7 efficiency. But with growing automation comes one big question — is AI-based trading really worth the risk?

This guide breaks down how AI trading works, its potential rewards, and the hidden dangers investors should know before jumping in.

💡 What Is AI-Based Trading?

AI-based trading (also called algorithmic trading or quant trading) uses machine learning algorithms to analyze vast amounts of market data, predict trends, and execute trades automatically.

These systems learn from historical data, market patterns, and real-time news — far faster than any human could.

Example:

An AI model can scan 10,000+ stocks, evaluate price momentum, detect social sentiment from Twitter, and make a buy/sell decision — all in seconds.

⚙️ How AI Is Changing the Trading Landscape

AI has transformed the trading world in four key ways:

- Speed & Automation:

Algorithms can execute trades in milliseconds, exploiting micro-opportunities before humans react. - Data-Driven Decisions:

AI uses predictive analytics, sentiment analysis, and pattern recognition — leading to smarter decisions. - 24/7 Market Monitoring:

Unlike humans, AI bots never sleep. They track global markets around the clock. - Reduced Emotional Bias:

Emotional mistakes — like panic selling or greed-based buying — are minimized.

💬 “In modern markets, the edge is no longer just information — it’s interpretation speed.” — Brian Dean, Backlinko Finance Analysis 2024

🧠 Types of AI Trading Systems

Not all AI trading platforms work the same way. Here are the main types:

1. Predictive Algorithms

These use machine learning to forecast price movements. They adapt over time, refining predictions based on performance data.

2. Sentiment Analysis Models

These track news headlines, social media, and global sentiment to detect market mood. For example, tools like Trade Ideas and Kavout leverage this method.

3. High-Frequency Trading (HFT) Systems

HFT algorithms execute thousands of trades per second — often used by large hedge funds and institutional investors.

4. Robo-Advisors

Platforms like Betterment and Wealthfront use AI to manage diversified portfolios for retail investors — perfect for beginners.

✅ Benefits of AI Trading

AI trading isn’t just hype. Here’s why it’s gaining traction among investors:

1. Speed and Efficiency

AI can process millions of data points per second — from charts to economic reports — ensuring lightning-fast execution.

2. Emotion-Free Decision Making

Unlike human traders, AI systems stick strictly to logic and data, avoiding FOMO or panic selling.

3. Data-Backed Accuracy

AI tools continuously learn and improve using backtesting and real-time feedback loops.

4. Scalability

One algorithm can manage multiple accounts or assets simultaneously — impossible for human traders.

5. Accessibility

Platforms like TradeSanta, 3Commas, and Pionex allow retail traders to automate strategies with minimal coding knowledge.

⚠️ Risks and Challenges of AI-Based Trading

AI trading might sound like a “money machine,” but it’s not risk-free. Here are key challenges:

1. Overfitting

AI models sometimes perform perfectly in backtests but fail in live markets due to overfitting on historical data.

2. System Failure

Even minor coding errors can trigger massive financial losses. In 2012, Knight Capital lost $440 million in 45 minutes due to a software glitch.

3. Market Volatility

AI systems can misinterpret black-swan events (like COVID-19) and make unpredictable trades.

4. Ethical and Regulatory Risks

As AI influences global markets, regulators are tightening control to prevent manipulation and flash crashes.

5. Dependence on Data Quality

Garbage in, garbage out — poor-quality data leads to flawed decisions.

⚠️ Tip: Always use platforms with transparent algorithms and strong compliance measures.

📊 Real-World Examples of AI in Action

AI trading is already dominating the markets:

- Renaissance Technologies uses AI to run one of the most successful hedge funds in history, with annual returns above 30%.

- Citadel Securities employs machine learning for market-making and risk management.

- Retail platforms like eToro’s CopyTrader use AI to analyze and mirror top traders’ performance.

Even Elon Musk’s xAI has hinted at future financial data analysis applications — showing AI’s growing cross-industry relevance.

🤝 AI vs. Human Traders: Who Performs Better?

| Category | AI Traders | Human Traders |

|---|---|---|

| Speed | Milliseconds | Seconds–minutes |

| Emotion | None | High |

| Adaptability | High (learning models) | Moderate |

| Intuition | Limited | Strong |

| Risk Management | Data-based | Experience-based |

Verdict:

AI outperforms humans in speed and data analysis but lacks emotional intelligence and adaptability in unpredictable situations.

The best traders in 2025 will likely be hybrids — humans using AI tools to amplify decision-making.

🧭 How Beginners Can Safely Use AI Trading Tools

If you’re new to AI-based investing, follow these steps:

- Start Small — Test with demo accounts or small capital.

- Choose Reputable Platforms — e.g., 3Commas, Pionex, Capitalise.ai.

- Backtest Before Going Live — Always test strategies on historical data.

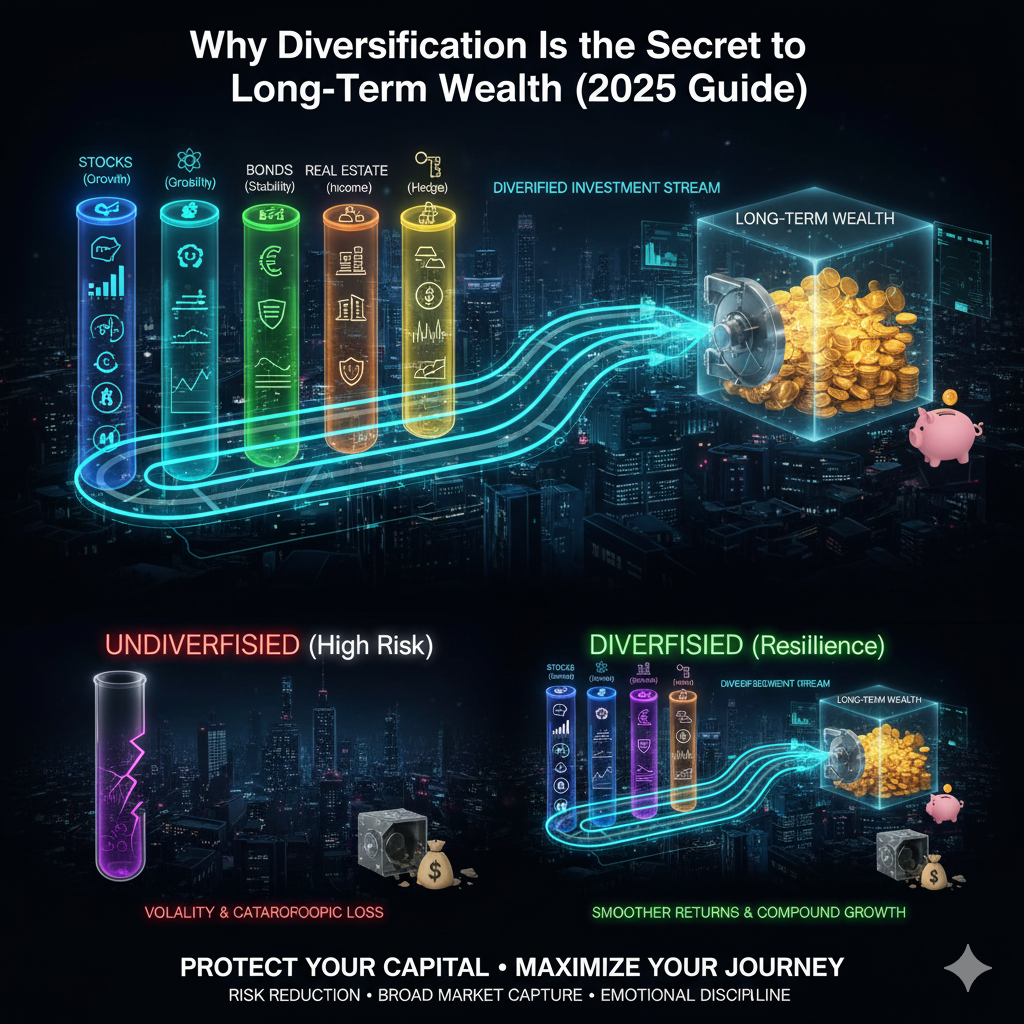

- Diversify Assets — Don’t rely on one algorithm or market.

- Monitor Performance — AI can automate trades but still needs oversight.

🧩 Pro Tip: Use Google Sheets + TradingView integration to manually track your bot’s performance metrics.

🔮 The Future of AI Trading: Trends to Watch in 2025 and Beyond

Here’s where AI-driven investing is heading:

1. Explainable AI (XAI)

Regulators and traders want algorithms that explain why they make decisions, not just results.

2. Integration with Blockchain

AI + blockchain ensures transparency, especially for decentralized exchanges (DEXs).

3. Quantum Computing Synergy

Future AI trading models may use quantum data processing — exponentially increasing prediction power.

4. Retail AI Bots

As no-code AI tools evolve, everyday traders will soon customize trading bots as easily as mobile apps.

5. Regulatory Frameworks

Expect new global standards for algorithmic trading compliance, security, and ethics.

🧰 Free Tools for Smarter AI-Assisted Investing

You don’t need a hedge fund to access powerful AI insights. Try these free tools:

- Google Trends: Track market sentiment or keyword shifts.

- TradingView: Backtest strategies and visualize data.

- Ubersuggest: Monitor trending sectors and financial keywords.

- CoinMarketCap AI Tools: For crypto sentiment and volatility tracking.

- Google Colab + Python: Build basic AI trading bots using free data sets.

💬 Off-Page SEO Tip:

If you run a finance blog, share AI-trading case studies on LinkedIn or Medium and build backlinks via guest posts on fintech blogs like Hackernoon or Medium Finance. Authority and trust = rankings.

🧩 Conclusion: Is AI Trading Worth the Risk?

AI-based trading is transforming finance — faster execution, smarter insights, and fewer emotional errors.

But it’s not a silver bullet. Overreliance without understanding the underlying models can lead to massive losses.

The key takeaway:

Use AI as a tool, not a replacement.

Combine technology with strategy, discipline, and education.

If done right, AI-based trading in 2025 isn’t just the future — it’s the edge that separates successful traders from the rest.

❓ FAQs

1. Is AI trading legal?

Yes, as long as the platform complies with financial regulations and anti-manipulation laws.

2. Can AI trading guarantee profits?

No system guarantees profits. AI enhances data accuracy but can still fail in unpredictable markets.

3. How much do I need to start AI trading?

Many retail platforms allow starting with as little as $100–$250.

4. Which AI trading platform is best for beginners?

Try 3Commas, Pionex, or Capitalise.ai — beginner-friendly and transparent.

5. How can I learn AI trading safely?

Use demo accounts, backtesting tools, and communities like r/algotrading on Reddit or TradingView forums.